In recent weeks, you may have noticed that the price of many goods has been rising. According to figures from the Office for National Statistics, According to figures from the Office for National Statistics, the rate of inflation increased by 3.8% in the 12 months to October.

One of the proposed solutions to this issue is for the Bank of England (BoE) to raise its base rate, which would encourage other banks to raise the interest rates that they charge. However, this could have significant economic consequences.

If rates did rise, the change could impact mortgage-holders the most. If you’re one of them, read on for how it could affect you and what you can do about it.

The Bank of England has hinted at an interest rate rise in the near future

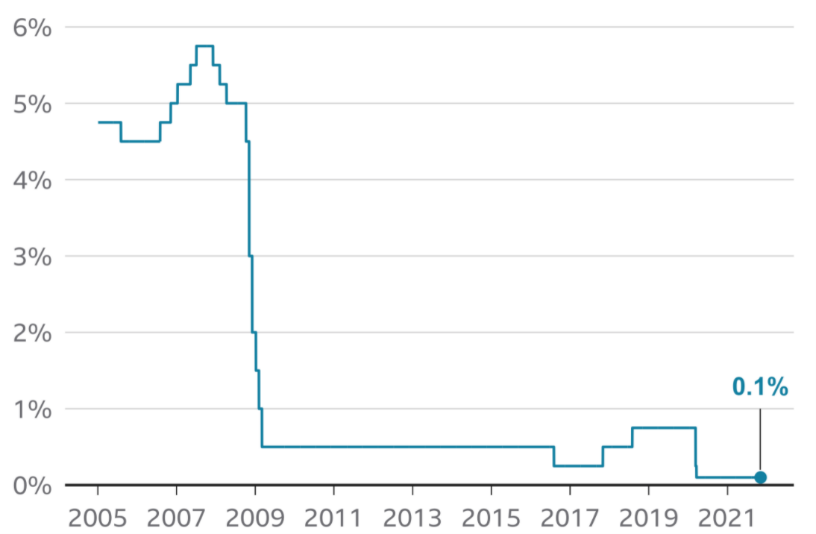

As you may have read in the headlines, there has been much speculation recently over whether the BoE will raise the base rate in coming months. Since the start of the coronavirus pandemic in early 2020, it has sat at the historic low of only 0.1%.

While the Monetary Policy Committee chose not to raise the base rate when they last met on 4 November, they have hinted that they may increase it if inflation continues to rise.

The base rate is an important tool for influencing the economy as it affects the amount of interest that other financial institutions have to pay when borrowing from the BoE. In turn, they then pass these costs onto their customers.

This has two main effects: it will change both the amount of interest that you would earn on your savings, but also the amount that it costs you when you take out a loan. As you might imagine, the latter reason can have a significant impact on mortgage-holders.

A rise could make it harder for first-time buyers to get onto the property ladder

Since the 2008 financial crisis, homebuyers have been able to take advantage of low interest rates on their mortgages. This is because the BoE lowered their base rate in the aftermath to encourage more economic activity.

Source: BBC

However, with the BoE’s recent announcement that they may be raising the rate in the near future, this era of cheap loans might be about to end. According to the Guardian, several lenders have already repriced their home loans upwards and withdrawn some of their cheaper mortgages.

This can pose an obvious problem for first-time buyers, as it means that available mortgage products will be more expensive, potentially pushing them out of reach for some people.

Of course, if you’re concerned about this prospect then it can be helpful to save up for a larger deposit. The benefit of doing this is that you can gain access to a much wider array of potential mortgage deals.

If you’re struggling to do this, your parents may be able to help by providing you with a gift or loan of cash, as we discussed in a previous article.

An interest rates rise could make repayments for mortgage holders more expensive

If you already have a mortgage, then a change in interest rates could mean that your monthly repayments may rise. This could potentially affect people who are paying variable- or tracker-rate mortgages now, and borrowers with a fixed-rate mortgage in the future.

According to figures published by the BBC, there are around 1.1 million people in the UK who are choosing to pay their lender’s standard variable rate (SVR). If you’re one of them, then an interest rate rise could directly affect you, as your lender is likely to increase their SVR in response.

However, the change could also impact you if you’re on a fixed-rate mortgage. According to industry data published in the Guardian, around 74% of UK borrowers are on this kind of deal.

While the change won’t affect you until the end of your term, of course, you may find it’s more expensive when you come to remortgage.

Working with a broker can help you save money when remortgaging

If you have a mortgage and want to avoid the impact of a future interest rates rise, you could benefit from seeking professional advice.

Whether you’re currently approaching the end of your fixed-rate term, or you are on your lender’s SVR and want to change to one, a broker can help you to save both time and money.

Not only can they scour the market on your behalf, but they often also have access to a much wider array of products than you would if you searched for yourself. This can help you to rest assured that you’re getting the best mortgage for your needs.

Get in touch

If you’re concerned about the impact of a future interest rates rise and want to know more about how a broker can help you, please get in touch. Email info@oundleandstamfordmortgages.com or call us on 01832 272653.

Please note:

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.