The social distancing measures put in place to slow the spread of coronavirus, unsurprisingly, affected the housing market. Viewings of properties were halted, estate agent offices closed and, worried about uncertainty, some buyers pulled out of purchases.

In April, as lockdown restrictions were in place, property transactions fell 53%. Some of the sales that stalled have moved forward but the market remains sluggish.

Now, the Chancellor has taken steps to encourage the housing market to get moving again by announcing some changes to Stamp Duty.

To stimulate the housing market, Rishi Sunak announced a Stamp Duty holiday until 31st March 2021. If you’re considering buying a new home, ensuring you get the keys before this point could save you thousands of pounds.

So, what do the Stamp Duty changes mean for you?

Stamp Duty threshold raised to £500,000

Stamp Duty is a tax you pay when purchasing property or land in England and Northern Ireland. Scotland and Wales have similar property taxes.

Previously, Stamp Duty was payable if you bought a property for more than £125,000 unless you were a first-time buyer. The threshold has temporarily increased to £500,000 in a bid to encourage movement in the property market.

Nine in ten people buying a home between now and March will no longer need to pay Stamp Duty. The average bill will fall by £4,500, and so bringing plans to move forward could save you money.

For most first-time buyers, the Stamp Duty cuts will have little impact financially. First-time buyers paying up to £300,000 for a property were already exempt from the tax. However, the cuts are still positive. It will encourage more homeowners to sell and you could benefit from more choice in the market in the coming months.

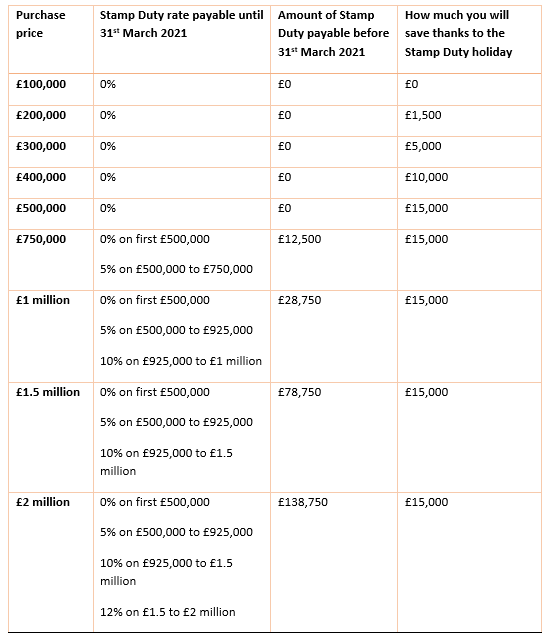

The table below shows how much you could save if you purchase before 31st March 2021.

Purchasing a second property

If you’ve been thinking about investing in a second property, the raised Stamp Duty threshold applies to you too. This includes buying a holiday home or a Buy to Let investment.

Second properties incur a 3% Stamp Duty surcharge. This will still be due, but, assuming you pay less than £500,000, you won’t have to pay the standard Stamp Duty rate alongside this. It could significantly cut costs when buying a second property – whatever your plans for it are.

If you were to purchase a second home before 31st March 2021 costing £250,000, you’d now pay Stamp Duty of £7,500, saving you £2,500.

Filing a Stamp Duty return

You have 14 days after you complete on the purchase of any property to file a Stamp Duty return to HM Revenue & Customs. You will need to pay any Stamp Duty due by this date too.

Even if you don’t owe any Stamp Duty, including if it’s due to the raised threshold, you still need to submit a return. This applies to first-time buyers as well.

Your solicitor will usually deal with the return and pay your Stamp Duty bill on your behalf, but you can do it yourself. If you don’t pay the full amount on time, daily interest will also be due, so if you’re handling the return and bill yourself, keep this in mind.

Get in touch

During this time, we’re open for business and can help you with any mortgage or protection needs that you have.

If you’d like to discuss moving home and what the Stamp Duty rates mean for you, please contact us. Email info@oundleandstamfordmortgages.com or call us on 01832 275828.

Please note

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation which is subject to change.