Last month, the Bank of England voted to keep interest rates on hold. Despite recent economic data pointing to a possible cut in the cost of borrowing, the Governor of the Bank of England, Mark Carney, said: “the most recent signs are that global growth has stabilised”.

The nine members of the Bank’s Monetary Policy Committee (MPC) have been split for several months on whether to lower interest rates. With Carney suggesting that the Bank are ready to reduce rates if necessary, here’s your guide to what a Base rate cut would mean for your mortgage.

Many experts predict rates will fall in 2020

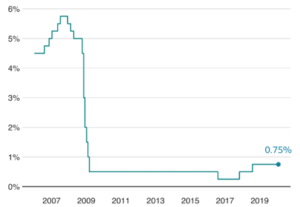

The Bank of England Base rate has been at a historically low level since the global financial crisis in 2009. The last increase to the rate happened in August 2018, and the rate has sat at 0.75% since then.

So, why do many experts think that interest rates will fall in 2020?

One of the reasons is that the rate of inflation in the UK is currently well below the Bank of England’s own target – at 1.3% compared to a target of 2%. If the Bank thinks inflation will remain at this level, it might cut interest rates to lower the cost of borrowing and to encourage consumers to spend.

Additionally, if the economy continues to struggle, the Bank can provide a boost by reducing the cost of borrowing.

A combination of these reasons has led many experts to predict that the rate could fall in 2020.

What a Base rate cut means if you’re looking for a new mortgage

A decade of record low interest rates has given a huge boost to mortgage borrowers. The cost of mortgages has fallen gradually in recent years, with many lenders now offering fixed and tracker rate mortgages at less than 2%.

If you’re looking for a new mortgage in 2020, then you will certainly have an excellent choice of deals at very low interest rates. This is partly because of the low interest rate environment, but also because of strong competition between lenders. Banks and building societies are competing fiercely for new business, and this ‘race to the bottom’ has given borrowers access to better and better deals.

First-time buyers have been some that have benefited most. Moneyfacts report that the rates on mortgages that need a smaller deposit were cut by more than any other type of deal in 2019, mainly thanks to strong competition for first-time buyer business.

- The average two-year fixed rate for a borrower with a 5% deposit fell from 3.46% to 3.24%

- The average five-year fixed rate for a borrower with a 5% deposit fell from 3.86% to 3.55%

- The average ten-year fixed rate for a borrower with a 5% deposit fell from 5.05% to 4.09%

A further cut in interest rates could see the cost of borrowing reduce even further, with even more attractive deals on the market.

Of course, if you’re thinking of choosing a tracker deal, then a Base rate cut would see your rate fall. If you pick a mortgage that is directly linked to the Bank of England Base rate, the rate you pay (and your monthly repayments) will rise and fall in line with the Base rate.

What a Base rate cut means to your existing mortgage

If you have an existing mortgage, then a Base rate cut could affect your monthly repayments. This will depend on the type of mortgage you have.

Fixed rate

In recent years, fixed-rate mortgages have become hugely popular as borrowers take advantage of the certainty of a guaranteed payment at record low interest rates.

If your mortgage is on a fixed rate, any change in the Base rate won’t affect your monthly repayments. So, if the Base rate were to fall, you wouldn’t see a reduction in your repayments.

Tracker rate

If your mortgage is directly linked to the Base rate, any cut in the rate will result in lower repayments. For example, if the Bank of England cut the Base rate by 0.25%, your mortgage rate would also fall by 0.25%, reducing the amount you pay each month.

Variable rate

If your mortgage is linked to your lender’s Standard Variable Rate (SVR) – perhaps because you are on a discounted rate, or because you are on your lender’s SVR – then it is possible that your repayments may fall if the Base rate is cut.

However, in the immediate aftermath of the last Base rate cut in 2016, the BBC reported just five lenders confirmed that they would pass on the 0.25% cut by reducing their Standard Variable Rate. So, if you are on a deal linked to your lender’s SVR, you may or may not benefit from a rate cut, depending on whether your lender decides to pass on the reduction.

What about my savings? What would a Base rate cut mean?

While low interest rates have been great news for borrowers, savers have endured a decade of low returns.

If the Bank of England decide to cut the Base rate, this is likely to result in even lower savings rates and more misery for savers.

Moneyfacts report that, after the last interest rate cut in 2016, the average savings rate for an easy access bank account fell by 0.14% in the ensuing three months.

Get in touch

Do you have any questions about what a Base rate cut would mean for you? If so, or you’re looking for a new mortgage or you want to get a better deal on your existing mortgage, please get in touch. Email info@oundleandstamfordmortgages.com or call us on 01832 275828.

Please note

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it. Think carefully before securing other debts against your home.